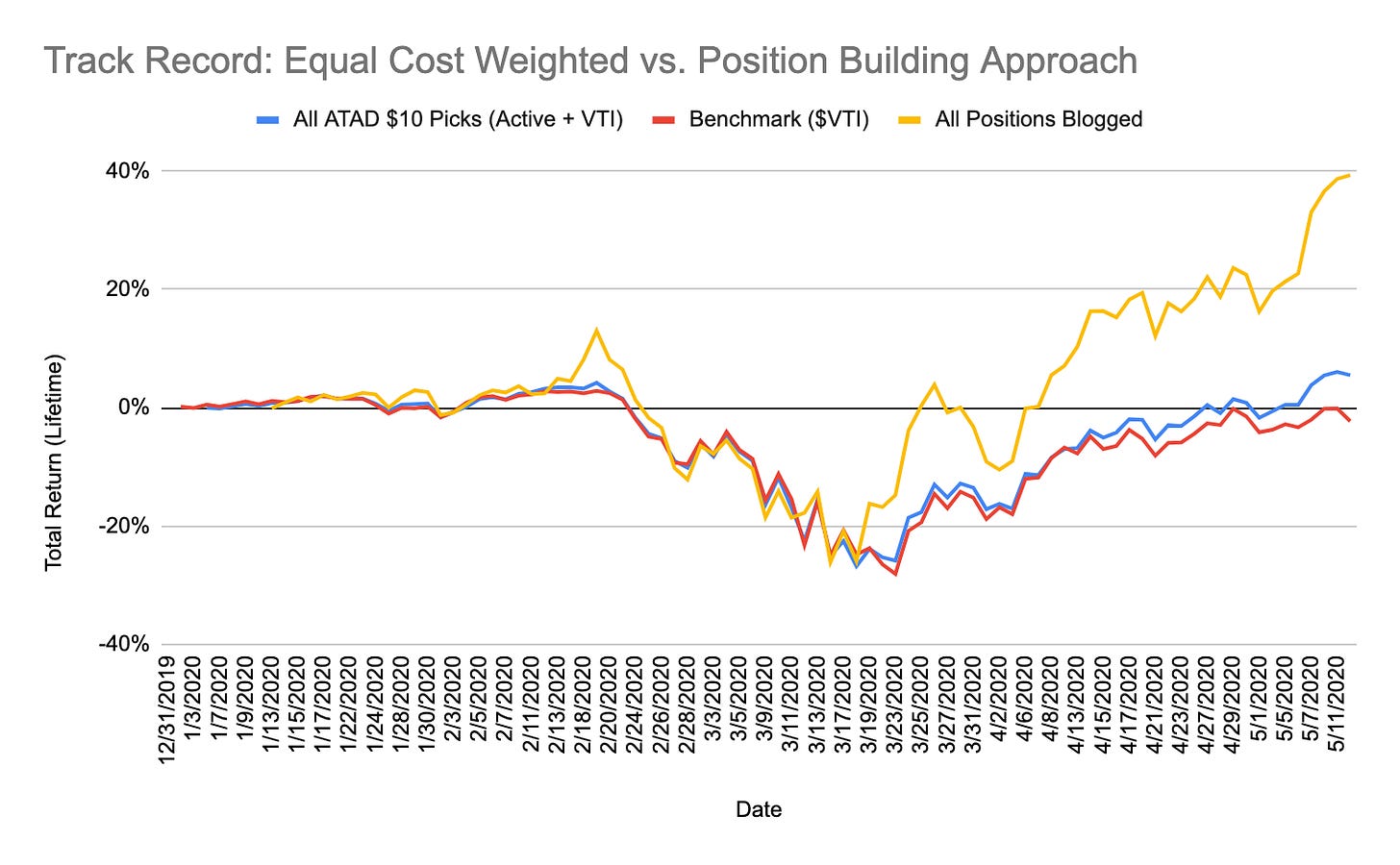

Now that the ATAD portfolio is up 39% YTD (upgrade to access the detailed track record spreadsheet and see all my transactions) versus -2% for our benchmark $VTSAX, I’m starting to wonder. As you can imagine, I’m having a lot of thoughts as I sip this glass of wine. Such as:

This is too good to be true, and won’t last

Price only matters when you’re buying or selling

I wishI had bought 10x of each position (of course) in this experiment

This market is insane and their can’t possibly be anything priced reasonably enough to buy at this point.

Inflation is lagged, but it’s going to be > 30%

What is going to happen to the average American’s retirement account?

Ugh.

This is a good moment to remember that I can’t predict the future so items 3 through 6 are crap and with NIRP on the horizon there’s no point in hoarding my cash. So let’s keep hunting for some companies worth owning, shall we?

Given the current economic situation, let’s just keep walking through our alphabetical list for now to see if we can uncover some overlooked winners. We’re going to look for growing companies with plenty of cash, not much debt, decent margin, ideally not super complex supply chains, a decent brand within their sphere and some sticking power while consumer spending continues to plummet alongside unemployment.

I’m going to be pretty brutal here in skipping the ones that don’t capture my fancy…

Disclaimer: You understand that by reading “A Ticker A Day” you are not receiving investment advice. No content published here constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. You further understand that the author(s) are not advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent that any of the content published may be deemed to be investment advice or recommendations in connection with a particular security, such information is impersonal and not tailored to the investment needs of any specific person. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on “A Ticker A Day” will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information.

“A Ticker A Day” is not intended to provide tax, legal, insurance or investment advice, and nothing published here should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by its author(s) or any third party. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should consult an attorney or tax professional regarding your specific legal or tax situation.