Other than buying my house, purchasing my GitLab stock options is the largest transaction I’ve made as an investor, and I had to sell some of my beloved Twilio stock to do it. I’ve witnessed millions wired into a startup bank account before, which is an awe-inspiring moment for anyone who appreciates the art of the sell side, but I discovered it is even more magical to find something of that size which I want to buy.

Getting Into GitLab

When I decided to re-enter the W-2 employment world in early 2019, it was not without trepidation. I had been on sabbatical for 10 months and wasn’t quite ready to cut it short. Fortunately, GitLab’s CEO made the decision easy for me when he made me an offer I could not refuse. I made a spreadsheet to evaluate the compensation package against the company’s financials and market prospects, and immediately knew I wanted those stock options. I wasn’t sure what it would be like to be an employee again after 6 years as a founder and CEO, but I consoled myself that even if I made it through half of the vesting schedule, it would be well worth the time. Besides, I needed something to distract me from the volatility of $TWLO, and I wanted a more diversified skin-in-the-game position within the developer tools space eventually.

I started out leading an internal startup incubation of Meltano, but ultimately hired my replacement from among the most tenured technical GitLab team members. The company has recently spun out with a $4.2M seed round led by GV, and I am proud to be an investor. Next up, a series of stints in Marketing reporting to the CMO.

GitLab’s transparency value made it easy to educate myself on the company. Not only were the financials, board meeting agendas, budgets, and plans all accessible to all employees... I also reported to the CEO directly for my first year, and had the opportunity to observe his process and character first hand. I participated in many enrichment activities such as the CEO Shadow program, Minorities in Tech Mentorship, and used the publicly available org chart to identify and meet with more than 150 high impact individuals who I tracked carefully on a spreadsheet.

Quite frankly, I am uniquely positioned to value the company’s stock after doing these and many other activities that are only possible for employees. Now the question becomes how to maintain my informational advantage now that I am outside of the company, but that’s a topic better left for another time.

For reference, the day I started my job at GitLab (Feb 2019) $TWLO was trading around $116/share, and it is $376/share today. I’m glad I left it alone.

Concentration Risk

My liquid net worth breakdown (excluding my house + private companies) looks like:

98.1% US Stocks

1.2% International Stocks

0.3% Bonds

0.2% Cash

0.2% Alternatives

Some might say this is a fairly typical asset allocation for a young healthy person with an appetite for risk and lot of compounding ahead of them in the future. Some might say I am crazy and really should be more diversified.

Sliced it a different way, I realize why the folks at my bank have to call me and read me a concentration risk acknowledgement on a quarterly basis:

88% Twilio

10% Other U.S. Stocks

~2% Everything else

This excludes my illiquid private company portfolio, which includes angel investments I made in at least 2 companies valued at > $1 billion and my GitLab stock.

Assuming GitLab stock were liquid today at its most recent FMV, my portfolio concentration would look like this:

57% Twilio

35% GitLab

6% Other US Stocks

~2% Everything Else

I don’t know what you’ll think when you look at all this. Maybe it means nothing to you, but to me it makes me think damn, maybe I really do have balls of steel?

Is it balls of steel, or luck, or stupidity? I honestly don’t know, but so far the results tell me that what I am doing is right. Twilio IPO was 5 years ago, and I have held most of the original stock (via early exercise options) since 2009, other than diversifying a bit by purchasing a house in Denver in 2019. My cost basis was $3 to exercise + pretty much all the waking hours of my life from age 23 to age 27. I didn’t have any cash to invest when I met Jeff Lawson, so I took the next best option: a job. Just imagine how the angel investors in that company did…

Where Do We Go From Here?

Do you ever feel like you’re searching for something, but when someone asks you to explain your quest you can’t put it into words? “I know it when I see it,” you might utter, before shuffling off to whatever you were doing before.

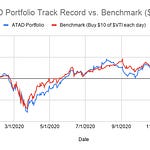

The concept of A Ticker A Day is a fun exploration across a huge set of companies, and I’m trying to decide if that’s where I want to continue to go with my investment explorations. What am I really looking for in this process? What is the meta-game above the playful alphabetical search? For me, it’s about finding that next great company, and now that I’ve purchased my GitLab options I feel like I’ve reset the chess clock and the search begins anew. I placed the Twilio bet in 2009, and the GitLab bet in 2019, so it makes me think I’m due for some maintenance hands (a poker term for singles and doubles) while I wait.

I wonder, will it take me until 2029 to find the next one?

Can I Find My Next Great Investment by 2029?