Hello from Lake Tahoe! We are on the road again, and I’m taking advantage of the slightly better AQI in the early morning to have some breakfast outside. The drive in on I-80 through Reno was very eerie with all the smoke, and I am so sad to see what is happening across the U.S. West this fire season.

Not only is California burning, but Oregon, Washington, Colorado, Utah, Wyoming, Idaho and Montana as well. If you’d like to help the victims, you can donate to American Red Cross and write in “California Wildfires” or “Oregon Wildfires” (or whatever your state is). For California wildfires, you can also text CAWILDFIRES to 90999 to make a $10 donation.

I recently finished reading “What I Learned Losing A Million Dollars”by Jim Paul and Brendan Moynihan (which Nassim Nicholas Taleb calls “One of the rare non-charlatanic books in finance”). The author shares many insights into how emotions and cognitive biases can lead investors to make decisions that ultimately lose them a lot of money. As far as practical advice goes, and the emphasis is on having controls that you set up when you are in a calm state of mind, and it got me thinking that I should give more thought to the controls and exit strategy for my investment decisions.

The Decision to Sell Zoom ($ZM)

With all this in mind, I started looking at an investment I made into Zoom just a few days after their IPO. I haven’t previously blogged this investment because I made the decision before 2020, but it is now included in the portfolio tracker spreadsheet.

On April 30, 2019 I purchased 68 shares @ $65/share, and sold the entire position on September 1st for $454.04/share, for a return of 598.5%. How did I make this decision?

First, I want to point out that because I didn’t clearly define an exit strategy ahead of time there is a very real risk of trying to attribute more logic and rationality to my decision than it actually had.

After reading Zoom’s Q2 earnings with my morning coffee, I took a long walk to digest the company’s +355% YoY revenue quarter. That kind of unprecedented growth is amazing, and yet I found my mind returning to my journey through buying into Tesla in early February, selling a portion of my Tesla position in mid-July for a +239% return. After that walk, I sold the rest of the position for +353%, and wondered whether this might be a similar situation for Zoom. In poker, especially in limit games, it’s well known that you reach a point in the session where you are up 2-3x and statistically the odds you’ll give it all back if you remain at the table make the only rational decision to cash out (even if it pisses off the other players, and requires you to walk to your car with a security guard). But I digress…

The book was on my mind, and I had started to draft this post about controls. My husband mentioned at coffee that Zoom’s stock was up 20% for the day, and my first thought was “gee I’m glad I didn’t sell it”. As we walked home, I checked my phone and saw it was now +40% in a single day, and my position was up ~600%.

“This is a pretty insane gain for a single day. Yes, I use Zoom for several hours every day both in my work life and personal life, but how long will it take for them to grow into this valuation?” Having a $129B market cap (its down a bit today) on $2.65B of annual revenue seems to be a very forward-looking valuation — it seemed to me like the market was pricing in future expectations spanning several years. What upside did I have, I wondered, in holding on just to find out if I was right ~5 years from now? Did I think I was so disciplined that I could weather the coming ups and downs and wind up ahead, versus taking the win and walking away? No, I don’t think I’m that good.

Two Portfolio Strategies

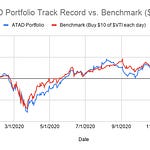

As I noodled on this post, the market continued to move away from Zoom, Tesla and many other tech names. I felt like I needed to put more wood behind the arrow on this topic than my initial post, so I spent a bunch of time cleaning up and curating my ATAD portfolio tracker spreadsheet (links for paying subscribers). On the “All Positions - Summary” tab I added a few new columns to help me filter the list more effectively: Days Since Purchase, Average Daily Return, and Value as % of Portfolio.

ATAD Portfolio Picks

Universe of Companies: everything underlying the $VTSAX, alphabetical order

Bet Size: fixed at $10 per decision

Holding Period: what I had in mind when I started this project was to have a holding period of “forever” to see how this bucket of selected companies performs as an alternative to the index, and minimize the number of decisions I would need to make.

Exit Strategy: When we get to the end of the year, I will take a look at rebalancing but would ideally leave this portfolio untouched for as long as possible to see if I am able to beat the index consistently over time.

Other Blogged Stock Picks

Universe of Companies: any other picks I’ve shared outside the alphabetical list, and positions I’ve taken the ATAD portfolio companies beyond the $10 bet size

Bet Size: Variable (no set strategy right now)

Holding Period: Variable (no set strategy right now), but trying to get to 1 year + 1 day whenever possible so that I will be paying long term capital gains.

Exit Strategy: I am not going to create rules for selling yet. For now, I am going to create a manual review process based on criteria that I can check anytime. I’d like to do this at least weekly, and maybe build some alerting for myself whenever a position meets the following criteria:

Upside Case: 1) average daily return is greater than the portfolio average 2) current value of the position is greater than 1% of the total portfolio value

Downside Case: 1) average daily return is in the bottom quartile of all portfolio holdings 2) current value of the position is greater than 1% of the total portfolio value

Exit Decision: Re-evaluate the company as if you were buying into it for the first time today. Would your decision still be a buy? I will write this up as posts.

Do Any Positions Meet This Criteria Today?

Within the portfolio spreadsheet (paying subscribers only) you can see that there are 4 companies who each make up 1% or more of my holdings. Within that set, there is one company who triggers the upside case, and another who triggers the downside. I look forward to sharing those analysis in future episodes.

What I’m Reading

August 31, 2020 — “Zoom Reports Second Quarter Results for Fiscal Year 2021”

Disclaimer: You understand that by reading “A Ticker A Day” you are not receiving investment advice. No content published here constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. You further understand that the author(s) are not advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent that any of the content published may be deemed to be investment advice or recommendations in connection with a particular security, such information is impersonal and not tailored to the investment needs of any specific person. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on “A Ticker A Day” will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information.

“A Ticker A Day” is not intended to provide tax, legal, insurance or investment advice, and nothing published here should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by its author(s) or any third party. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should consult an attorney or tax professional regarding your specific legal or tax situation.

Clarifying Portfolio Strategy & Controls