A smart reader suggested I calculate the anti-portfolio return of A Ticker A Day, and I found this so thought-provoking that I’ve put together a new tab in my track record spreadsheet to find out what this looks like.

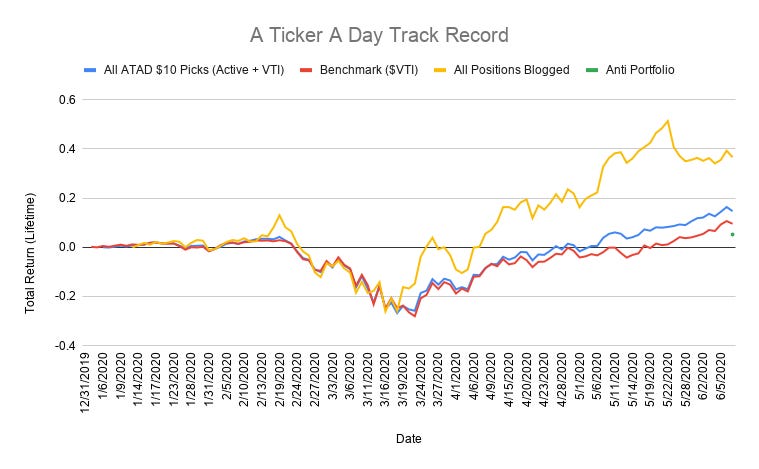

Overall, the ATAD anti-portfolio has returned 5.2% versus:

10% for my benchmark ($10 invested in the VTSAX every trading day)

15% for all ATAD picks ($10 invested in each stock at the day’s opening price)

37% for the overall portfolio I’ve blogged (including opportunistic trades)

Learning From the Anti-Portfolio

A few observations on the companies I’ve passed on:

4 companies (14% of passes) outpaced the overall portfolio

An additional 5 companies (18% of passes) didn’t beat the overall portfolio, but did outpace the ATAD picks portfolio

An additional 2 companies (7%) didn’t beat either ATAD or the overall portfolio, but did outpace the VTSAX benchmark

To see details on which stocks did what, including my biggest mist, visit the spreadsheet. I’ve highlighted the new tab labeled “Anti-Portfolio” with bright pink:

Legal Disclaimer: You understand that by reading “A Ticker A Day” you are not receiving investment advice. No content published here constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. You further understand that the author(s) are not advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent that any of the content published may be deemed to be investment advice or recommendations in connection with a particular security, such information is impersonal and not tailored to the investment needs of any specific person. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on “A Ticker A Day” will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information.

“A Ticker A Day” is not intended to provide tax, legal, insurance or investment advice, and nothing published here should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by its author(s) or any third party. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should consult an attorney or tax professional regarding your specific legal or tax situation.

Introducing the ATAD Anti-Portfolio