This is a free edition for all A Ticker A Day readers. I hope this will give you a sense of what kind of analysis lives behind the paywall, and consider upgrading to a paid subscription for $10/month or $100/year to get full access to our archives and spreadsheets.

On Saturday, I went to Target for some dog toys, fresh pillows and a throw blanket for our couch, and some cute and inexpensive summer clothes. After parking, I waited for ~10 minutes in the 90-degree midday heat along with 20-30 other shoppers. Everyone wore masks, stayed six feet apart, and were patient and polite. It was a bit dystopian to line up, but I’m getting used to it after many trips to Home Depot for my vegetable garden and occasional trips to Whole Foods for missing ingredients.

Since early March, we’ve primarily been getting our food delivered thanks to:

Instacart (much love to my YCombinator batchmates!)

ButcherBox (the modern “cow share” sourced meat - get on the waitlist)

Drizly (alcohol delivery from inventory in local stores)

ThriveMarkets (members only organic shopping, a virtual Whole Foods)

Goldbelly (food gifts from iconic restaurants - drop me a note for my referral link)

When I found myself in line for Target in the midst of a global pandemic (though we are open in Colorado and reporting very few deaths) I realized, “Wow I’m willing to risk getting sick, and grapple with the awkwardness of wearing a mask in the heat for a few hours straight. Maybe I’m an idiot, but maybe I should purchase Target stock…”

I’ve also made a handful of trips to Home Depot to get my raised bed vegetable garden going, and find some pretty pre-potted planters for the patio, and have popped into the Whole Foods down the street quite a bit for fresh ingredients that I want to hand select, mostly for a change of pace after 3 months of shelter-in-place.

Target Stores ($TGT)

Target is a department store chain that is like an all-in-one shopping mall, with departments for every major category of consumer goods from electronics to groceries, household good to athletic apparel. The company is branded as accessible across social classes, and I think of it as a more modern JCPenny/Sears. Stores are brightly lit and merchandised to feel more like Nordstrom, but with prices closer to Walmart.

Observations:

$58.45B market cap, profitable, with a PE ratio of 21.67

3.52% of shares held short

26.74% gross margins, 4.19% net margin

$8,883 net income per employee (e.g. an employee who works 40 hours a week, 52 weeks per year is generating $4.27 of profit per hour for the company on average)

$2.58B of cash and short term investments (+66% YoY) and $42.78B in total assets vs. $10.04B of long term debt (excluding capitalized lease obligations)

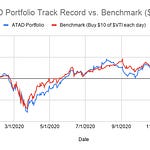

What I’m Doing: Buy. ($10 for ATAD picks, 1 share @ $116.12 for the portfolio)

What I’m Reading:

Home Depot ($HD)

I was at Home Depot again this morning, just killing time while I waited for the winter tires to be switched out, and it got me thinking that if I’m going to talk about places I still visited during the pandemic I have a few more to add to the list.

While I didn’t buy anything today, I have been to Home Depot at least a half dozen times in the past 2 weeks to get supplies for my raised bed garden. Mask on, usually arriving shortly after opening in the morning, and it’s been busy!

Observations:

Anecdotally: As people spend more time in their homes, those incomplete home improvement projects become more obviously needed and many people who still have their jobs but no longer have as much discretionary spending going on are adapting to remote work by putting their budgets into these projects.

Market cap of $270.6B, profitable with a P/E ratio of 23.99

1% of shares held short

32.28% gross margin, 10.2% net margin

$27,044 net income per employee (3X what Target makes per employee)

$2.13B in cash (+19.97%) and $51.24B in total assets vs. $27.59B in debt (excluding capitalized lease obligations)

What I’m Doing: Buy. ($10 for ATAD picks, 1 share @ $235.99 for the portfolio)

What I’m Reading:

Whole Foods Market (owned by Amazon: $AMZN)

After I evaluated Target and Home Depot, I had to take a look at my transactions for the last few months in greater detail. Where did I actually *go* immediately after Shelter in Place was lifted? The next up on the list was Whole Foods, which still got some visits for fresh fruit and vegetables despite mostly using delivery services. I also went there today, to get ingredients for the beef stew I’m making for a friend who is in town from New York. Socially distanced suppers on the patio are pretty great.

Whole Foods is no longer independent, as they were acquired by Amazon.com, but since I am also spending a fortune on Amazon let’s just take a look at them.

Observations:

Anecdotally on Whole Foods: There is almost always a line to get in when I go, they hand out masks to customers who don’t have them at the front door, and there are still very few packages of toilet paper on the shelves and a limit on how many you can buy. Otherwise, things feel normal inside.

Anecdotally on Amazon.com: My husband and I have had the conversation about impulse purchases, batching up our orders, conveniently forgetting our password, and needing an entire categorization system within our Personal Capital account to deal with the massive amount of money going to Amazon. I expect the company will own both Target and Home Depot someday, when the price is right.

$1.27T (trillion!) market cap, profitable with a PE ratio of 122.89

We also both personally and professional spend a LOT on Amazon Web Services, for our personal projects, volunteer projects, and formerly as founders both at Mattermark and Referly. I work for a developer tools company… I am massively bullish on this portion of the overall business

$14,521 of net income per employee (better than Target, only half as good at Home Depot)

Gross margin 40.99%, net margin 4%

$55.43B in cash and short term investments (+32.8% YoY) and $225.25B in total assets vs. $23.41B in long term debt

What I’m Doing: Buying $AMZN ($10 for ATAD, 1 share @ $2,620 for the portfolio)

What I’m Reading:

I hope you enjoyed this issue of A Ticker A Day, and it’s got me thinking about which things I used to spend the most money on before Covid-19, which are likely to rebound. Specifically in business travel, I’m thinking about airports, airlines, hotels, etc. I’m going to continue to noodle on this, and I encourage you to comment or reply with your own thoughts on where it might be worth me digging around next.

Disclaimer: You understand that by reading “A Ticker A Day” you are not receiving investment advice. No content published here constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. You further understand that the author(s) are not advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent that any of the content published may be deemed to be investment advice or recommendations in connection with a particular security, such information is impersonal and not tailored to the investment needs of any specific person. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on “A Ticker A Day” will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information.

“A Ticker A Day” is not intended to provide tax, legal, insurance or investment advice, and nothing published here should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by its author(s) or any third party. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should consult an attorney or tax professional regarding your specific legal or tax situation.

Investing Where I've Spent Money In Person During the Pandemic